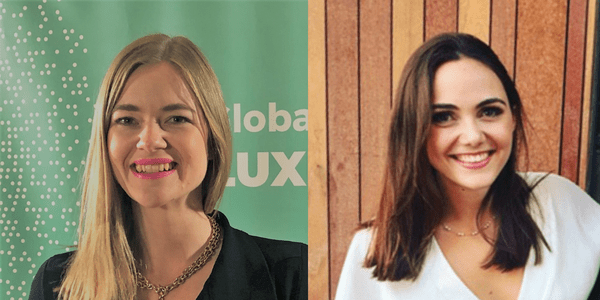

Systemiq celebrated a double win at the Environmental Finance Sustainable Company Awards, with Eliza Macmillan Smith winning the Rising Star – Under 30 award and Katherine Stodulka, head of Systemiq’s sustainable finance team, named Net Zero Champion of the Year. Both are driven by the real-world impact that a different financial system could have.

Eliza is the first to admit that taking a systems-eye view of sustainable finance is not the easy option. “You’re seeing the full picture,” she explains. “You’re actually considering the things we – as a global financial system – are still getting wrong… things that people find it quite easy to leave out of the conversation.”

But it’s an approach that started answering the questions she had had ever since studying philosophy of economics at university; so many of the issues she had been researching since seemed to lead back to the climate crisis. This was reinforced by her experience working on topics related to the architecture of the financial system during her time at BlackRock.

Since joining our Sustainable Finance team, Eliza’s work has included a strong focus on the ‘just’ energy transition in South Africa, which has seen her helping to shape discussions at the World Economic Forum annual meeting and COP26. The team have highlighted her ability to bring together leaders from the public, private and philanthropic sectors , and noted that she has been pivotal in ensuring integrity around high-level funding pledges – a role that has often seen her collaborating closely with Katherine Stodulka.

Over the past five years, Katherine has built the sustainable finance team based on the conviction that transforming the financial system will be critical to meeting climate targets.

Like Eliza, she is driven by the real-world impact that a different financial system could have. She said, “this agenda is investable – it’s not just about managing risk, but about capturing upside by investing in new technologies and geographies for low carbon, resilient and inclusive energy, food and urban systems”.

Katherine knows that this will be more challenging in the next decade than the last, with looming macroeconomic headwinds and a short term political bias. When the cost of finance is high, assets which are capital intensive to build but low/zero marginal cost to run (like renewable energy and other climate- and nature-positive business models) are less attractive – especially in emerging markets where the perception of risk is higher.

That is why much of her work focuses on “blending” public and private finance, channelling capital to areas where it is needed to accelerate investment in the transition to a net-zero economy by using de-risking instruments like guarantees, insurance, currency hedging and technical assistance to design high quality net zero projects.

She says “There’s significant funding available from multilateral development banks, but so often it is designed in a way that is not fit-for-purpose. If you are deploying capital that works for the capital provider but not the countries or communities where it will be deployed, then you will inevitably be solving for the wrong solutions.”

When asked whether she is excited about COP27 in Egypt – where many financial stakeholders will gather in November to discuss progress on climate action – Katherine welcomes the increased attention on adaptation finance and climate justice. She knows these big climate conventions don’t solve everything but believes in the drum beat they create for action and their ability to increase transparency.

With Systemiq’s sustainable finance team partnered up with leading players across the public, private and philanthropic sector and Systemiq Capital seeing no dip in their pipeline, Katherine hopes that mobilising the right capital for the right solutions really can be the great unlock for climate action.