The COP26 Edition of The Paris Effect finds the global economy is hitting positive tipping points on low-carbon power and transport – with all sectors set for a rapid shift away from fossil fuels in the coming decade.

Published today, The Paris Effect: COP26 edition finds that low-carbon solutions are hitting competitiveness across electricity and road transport, and within the next decade we can expect to see disruptive trends in multiple sectors including trucking, food & agriculture, aviation, shipping and others – supported by the Glasgow Breakthrough package launched at COP26 this week.

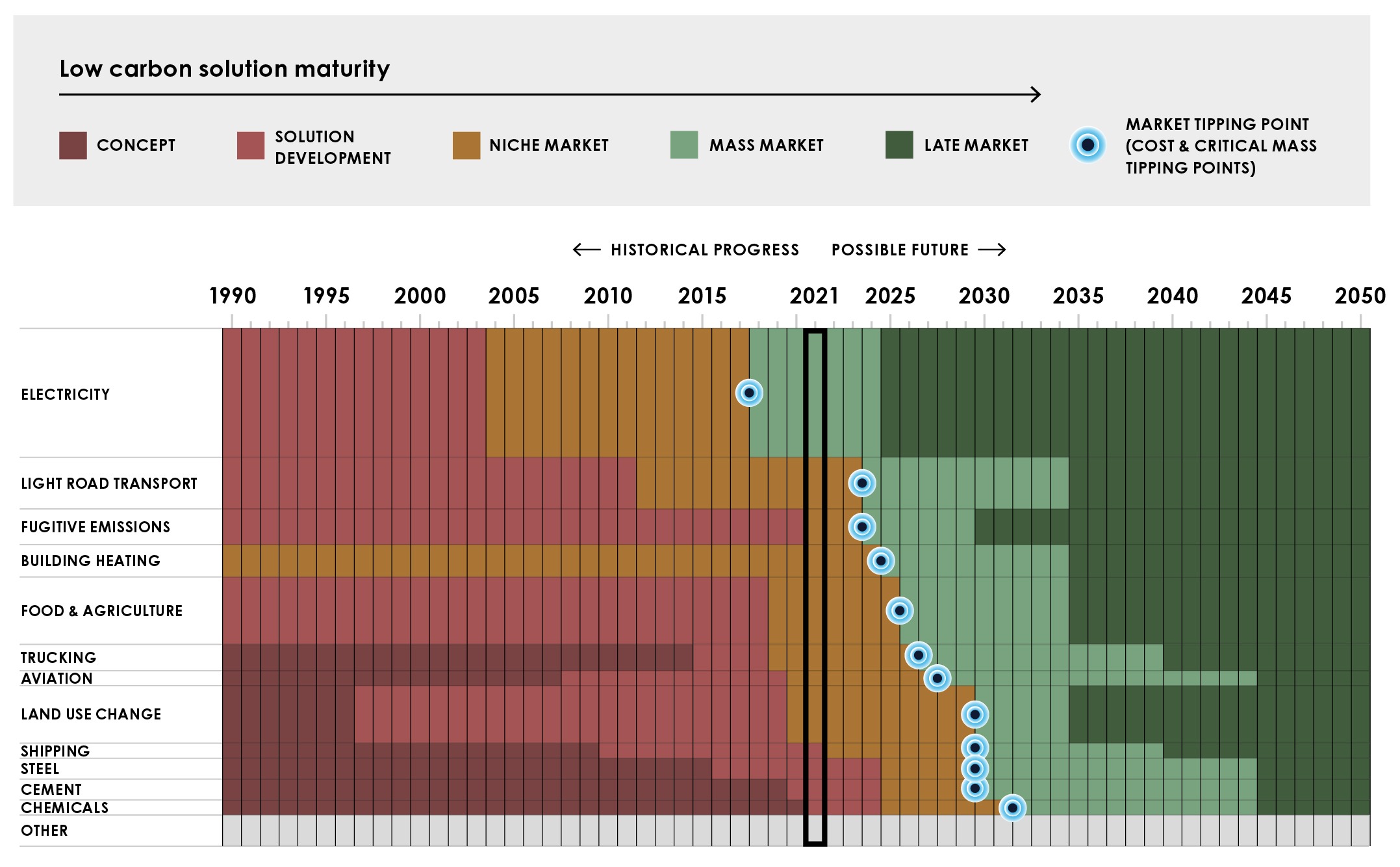

Building on our Paris Effect report published last year, the analysis highlights that with investment flows into low-carbon solutions, the world could see market tipping points in sectors representing 90% of emissions by 2030 and all emissions by 2035.

These findings expose that investment in new carbon-heavy infrastructure is now too risky, with all sectors well capable of bringing through competitive green solutions by 2030. For any high-carbon infrastructure asset built today, the revenues from 10-years out should be seriously questioned.

“In 2020, The Paris Effect made clear that weak or delayed action not only translates into potentially devastating climate risk, but also puts economies at risk of falling behind the next wave of the creation of prosperity”, says Nicholas Stern, Chairman of the Grantham Research Institute.

“The Paris Effect – COP26 edition highlights that on multiple fronts rapid technological innovation is accelerating, supported by scaling investment and increased ambitions.”

“It also makes clear that we need to do much more to mobilise capital for developing countries through creative combinations of international public finance designed to mobilise much larger flows of long-term private capital at much lower cost.”

But while the report finds that progress is accelerating on some fronts – it highlights successes in solar/wind and storage, electric vehicles, plant-based meats and green steel – the pace of change in other sectors is too slow. Energy efficiency, heat pumps and direct carbon removal, along with financing for nature-based solutions, are all identified as policy and investment targets.

Green for go: As they reach competitiveness through the 2020s, cleaner, low-carbon solutions across a number of sectors can break into mass markets and begin to scale.

Read the full report