The ocean is indispensable to life, providing numerous critical ecosystem services. It is a source of immense biodiversity, and is central to livelihoods for millions and food security for billions. It acts as a vital carbon sink, and protects coastal communities from the ravages of extreme weather events.

But our ocean is threatened by climate change, habitat destruction, over-exploitation and pollution. Creating a sustainable ocean economy represents a vast challenge, but also an unprecedented opportunity. The ocean contributes around $2.5 trillion to the global economy each year: if it were a country, it would be the 7th largest economy in the world.

What is the opportunity from blue bonds?

Blue bonds are one of the most promising emerging mechanisms that can help unlock finance at scale. Like conventional bonds, they are a fixed-income instrument, where bond investors lend money to the issuer, who agrees to repay a fixed interest rate and return the initial investment. While use-of-proceeds blue bonds are most common, sustainability-linked bonds, blue debt-for-nature swaps and other debt financing instruments can all be used to raise money for blue economy projects.

The blue bonds market is still small, but it is gaining traction and the prize is clear. If growth continues at the same rate as the more mature green bond market, blue bonds could mobilise up to $14bn of new finance in 2030 and close almost 10% of the estimated annual funding gap for SDG 14.

As the market grows, blue bonds can unlock finance for critical investments across the world. Our report focuses on two regions: the Middle East, North Africa and Turkey (MENAT) and Asia-Pacific (APAC).

- In MENAT, blue bonds could finance the transition to clean marine-based renewable energy, the growth of sustainable and ecotourism models, and vital water infrastructure that simultaneously tackles wastewater pollution and growing water scarcity.

- In Asia Pacific, blue bonds could unlock investment to address ocean pollution from plastic and waste water, to transition ocean sectors like fisheries and shipping to more sustainable models, protect and restore vital ecosystems, and to scale nature based adaptation solutions for some of the most climate vulnerable countries in the world.

For climate-vulnerable, low- and middle-income coastal and island nations, investing in a sustainable ocean economy can be a powerful lever to unlock low-carbon and climate resilient development pathways. Crucially, where combined with credit enhancement mechanisms that reduce investor risk and lower the cost of capital, blue bonds can be a source of finance for this crucial agenda.

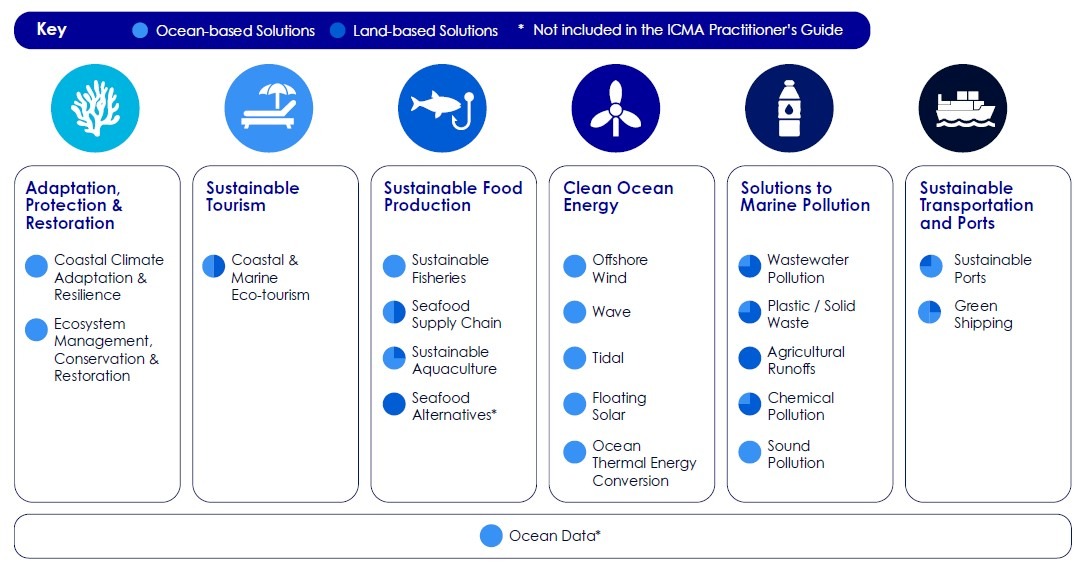

LANDSCAPE OF BOND INSTRUMENTS TO FINANCE THE SUSTAINABLE OCEAN ECONOMY

Blue and other ocean-themed use-of-proceeds bonds

Debt instruments to finance marine and ocean-based projects that have positive environmental, economic, and climate benefits.

As use-of-proceeds instruments, funds must be dedicated to blue projects within defined sectors.

Typical issuers: sovereigns and sub-sovereigns; MDBs, DFIs, other financial institutions; corporates.

Examples:

Sustainability-linked bonds with ocean-themed targets

Bond instruments for which the financial and/or structural characteristics can vary depending on whether the issuer achieves predefined targets for sustainability KPIs.

No restrictions on the use of proceeds but the issuer must report on the achievement of targets.

Typical issuers: sovereigns and sub-sovereigns; corporates.

Examples:

Sovereign debt-for-nature swaps / debt conversions

Financial transactions aimed at refinancing a country’s debt at a lower relative interest rate in return for a commitment to spend a portion of the savings on nature conservation. Usually a new ‘blue bond’ is issued,

but most of it is used to refinance the existing debt.

No restrictions on the use of proceeds but the issuer must report on the achievement of targets.

Typical issuers: sovereigns and sub-sovereigns, with support from MDBs, DFIs and other financial institutions

Examples:

What is needed to rapidly scale the blue bonds market?

High-integrity theme bond frameworks

Global and national frameworks can provide clarity to issuers on the sectors, projects and activities in scope and to assure investors that finance is deployed in high-impact interventions.

Developing and mainstreaming national ocean policy

Holistic ocean plans and integration with NDCs and NBSAPs can help align ocean management, policy and investment with macro national priorities for resilience, mitigation and prosperity

Robust pipeline of eligible projects

Early-stage concessional funding, capacity building, and pipeline aggregators and origination mechanisms like incubators, accelerators, project prep facilities can ensure a finance raised by blue bonds is deployed in high-impact projects.

Better and more transparent data

High-quality, reliable and comparable KPI frameworks and data is vital to establishing and upholding the credibility of a new asset class and building investor confidence.